Investing in the financial markets can be exciting and challenging. One key to success is understanding market cycles. Just like seasons guide farmers, market cycles help investors decide when to buy, hold, or sell their assets. Let’s explore how market cycles work and how you can use them to get better returns.

What Are Market Cycles?

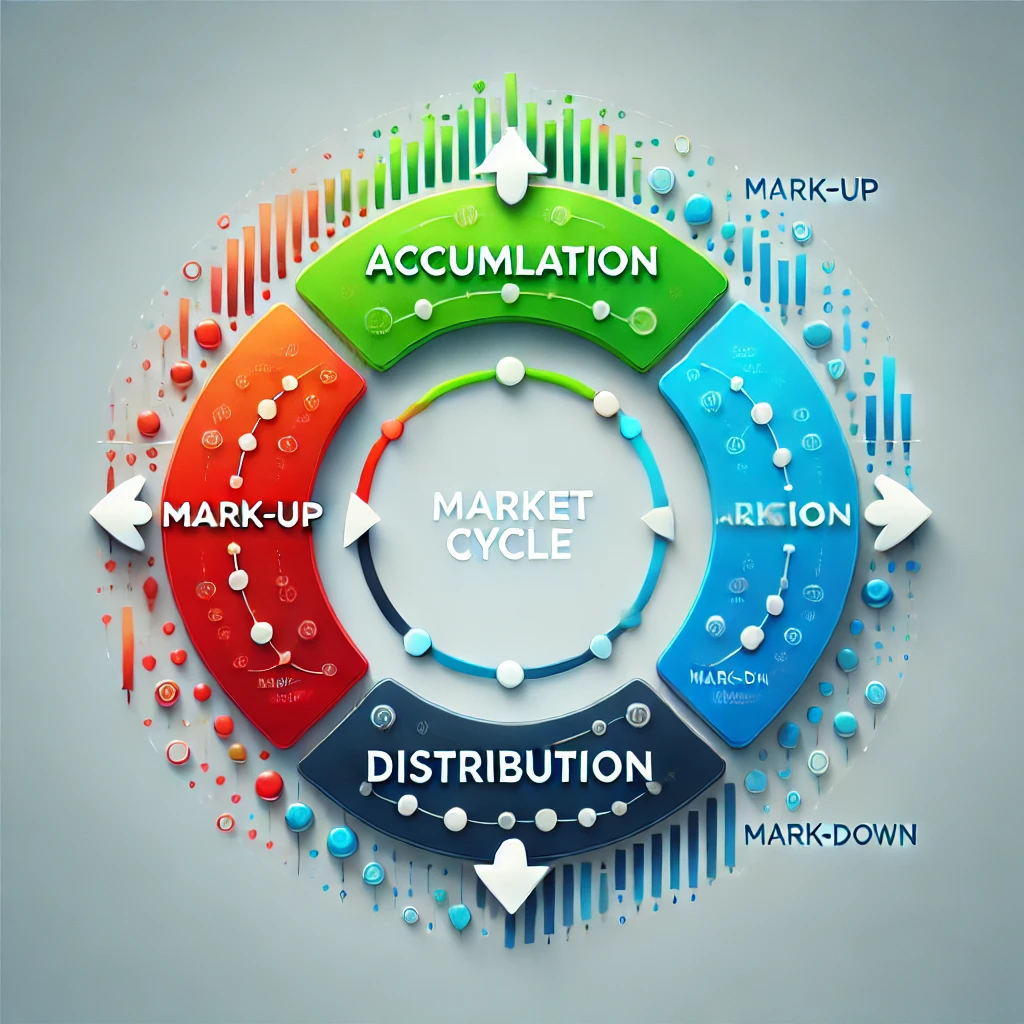

Market cycles are the repeating patterns of growth and decline in financial markets. These cycles happen because of changes in the economy, investor feelings, and world events. While each cycle is unique, they usually have four stages:

- Accumulation Phase: This phase comes after a market downturn. Prices are low, and most investors feel negative. Smart investors see this as a chance to buy cheap assets.

- Mark-Up Phase: Optimism grows, and prices start rising. More people join the market, and prices gain momentum.

- Distribution Phase: Market growth slows down, and prices reach their peak. Experienced investors start selling, expecting a downturn.

- Mark-Down Phase: Prices fall as fear spreads. This phase often sets the stage for a new accumulation phase, starting the cycle again.

How to Buy Smartly

Buying at the right time can improve your results. Here are some tips:

- Look at Fundamentals: During the accumulation phase, focus on stocks with strong fundamentals. These include companies with good profits, low debt, and steady growth.

- Use Dollar-Cost Averaging: If you’re unsure about the market bottom, invest a fixed amount regularly. This reduces the risk of buying at the wrong time.

- Watch Economic Indicators: Pay attention to signs like GDP growth, interest rates, and inflation. These can hint that the market is ready to recover.

When to Hold

Holding investments during market ups and downs requires patience. Here’s how to stay steady:

- Stick to Your Goals: Ignore short-term market swings. If your investment matches your financial plan, holding it during tough times can pay off.

- Rebalance Your Portfolio: Check if your investments are still balanced. Adjust them if needed to maintain your strategy.

- Control Your Emotions: Don’t let fear or greed push you into hasty decisions. Trust your research and plan.

Knowing When to Sell

Selling at the right time is just as important as buying. Look for these signals:

- High Valuation: If a stock’s price is much higher than its real value, consider selling. Use tools like the price-to-earnings (P/E) ratio to decide.

- Meeting Your Goals: If an investment has reached your financial target, it’s time to take profits.

- Weak Fundamentals: If a company’s performance is getting worse, like falling profits or higher debt, it might be time to sell.

The Importance of Diversification

Diversification means spreading your investments across different types of assets, industries, and regions. This reduces risk and increases the chances of good returns. A diverse portfolio can survive market downturns and take advantage of new opportunities.

Final Thoughts

Understanding market cycles is not about guessing the future perfectly. It’s about noticing patterns and making smart moves. Whether you’re in the accumulation, mark-up, distribution, or mark-down phase, having a plan for each stage is key.

Successful investing needs knowledge, discipline, and patience. By learning about market cycles, you’ll be ready to handle the ups and downs of financial markets.